In its 2017 Spring economic forecast published today, the European Commission included its economic forecast for Serbia.

Domestic demand is picking up, boosting imports and government revenues. Economic growth is forecast to strengthen mainly on the back of strong private consumption, while exports and investment are projected to remain robust. As a result, and also due to negative terms of trade, external imbalances are expected to widen. The budget balance is forecast to outperform targets and turn to a small surplus in 2018.

The economy surpassed its pre-crisis peak

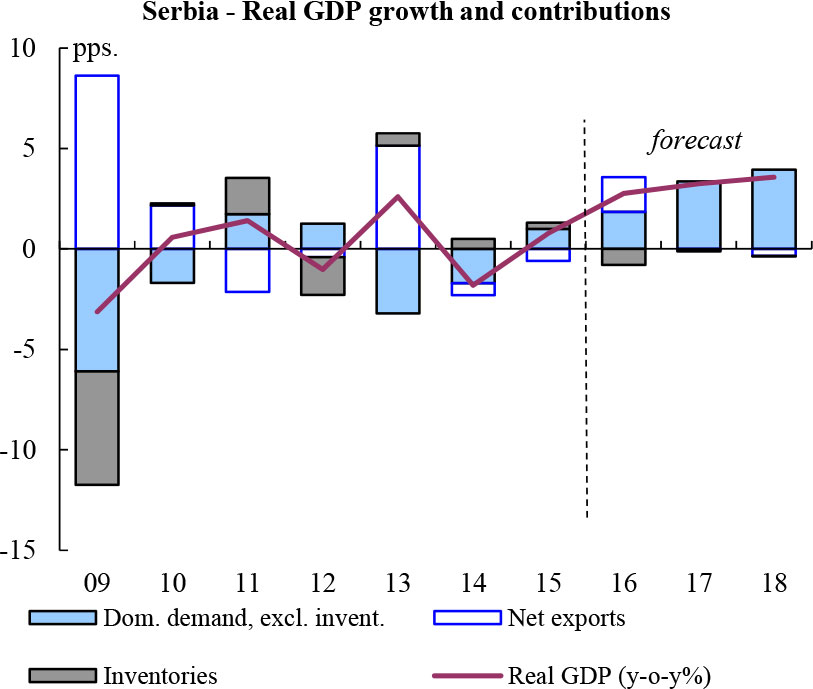

GDP growth increased to 2.8% last year – its fastest pace since 2008. It was supported mainly by a continuously strong expansion of exports and a modest increase in domestic demand. Household final consumption trended upwards, although its growth remained moderate despite an ongoing labour market recovery and vibrant consumer lending. Supported by higher government spending on goods and services, public consumption growth picked up as well. Although expanding vigorously in 2016 as a whole, investment disappointed in the last quarter of the year when it grew by just 2.6% (y-o-y) and was accompanied by a sizable negative contribution of changes in inventories. On the supply side, economic growth was broad-based as almost all sectors expanded.

High frequency indicators signal a continuation of the economic expansion. Industrial activity remained strong in the last quarter of 2016 but slowed down in early 2017, influenced by adverse weather conditions and base effects. Domestic and external trade remained robust and imports growth increased, indicating a pick-up in domestic demand.

Private consumption growth to sustain the momentum in the economy

Economic growth is forecast to accelerate and to be increasingly driven by private consumption. Continued gains in employment and higher income, in particular in the private sector, together with increasing consumer lending and the preservation of the overall macroeconomic stability should underpin the envisaged strong rebound in household consumption. Investment growth is expected to remain broadly unchanged, benefitting from FDI inflows and higher government capital expenditure. Nevertheless, the level of gross fixed capital formation would remain rather low at below 20% of GDP. Public consumption is likely to contribute positively to growth as government employment stabilises and expenditure on goods and services increases. Driven by rising demand in the EU, Serbia’s main export market, exports are forecast to remain robust. They are likely to be supported by incoming foreign direct investment in tradable sectors and productivity gains as a result of domestic reforms. Strong demand is set to push imports up, resulting in a negative contribution to growth from net exports over the forecast horizon.

Moderate price pressures and widening external imbalances

The surge in domestic demand and higher international oil prices are forecast to lift consumer prices. However, price pressures are likely to be contained in the short term as administered price adjustments stay limited and the central bank remains vigilant against excessive exchange rate movement. On the back of robust investment and consumption demand the current account deficit is expected to start widening again. However, it is forecast to remain fully covered by FDI inflows.

Uncertainties are high

The economy remains exposed to international capital flow reversals, divergences in monetary policies of major central banks, and fluctuations in commodity prices. In addition, geopolitical tensions, including in the neighbouring region, are non-negligible and could undermine investment and export demand. Domestically, risks relate mainly to the pace of the envisaged continuation of growth-friendly structural reforms and to maintaining a proper policy mix in the growth phase of the business cycle.

Budget surplus is within reach

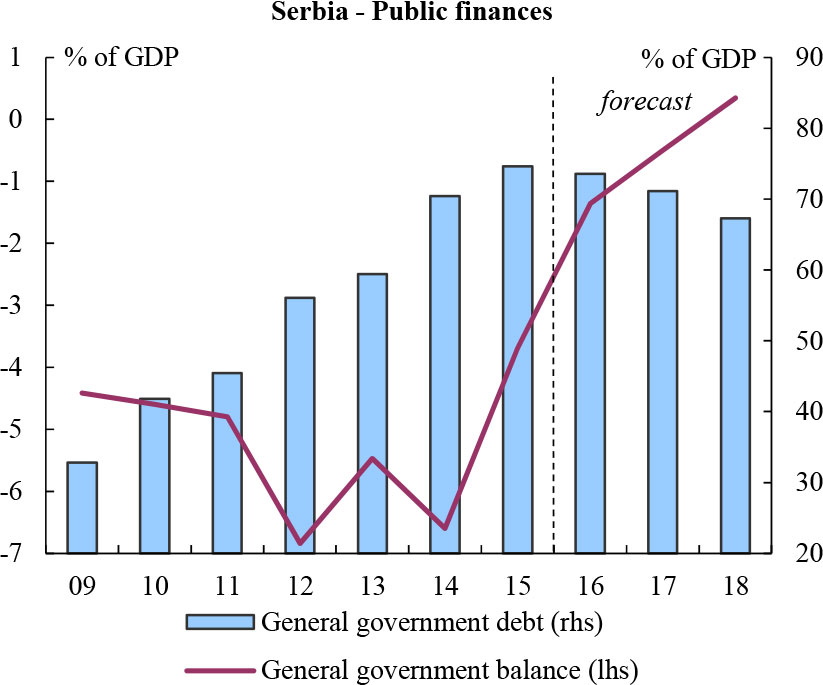

Following a marked reduction in 2015, the general government deficit was cut significantly again to 1.4% of GDP in 2016. The outcome outperformed by far initial and revised targets and was mainly due to stronger revenue growth. Favourable macroeconomic developments, improved tax collection, and unplanned one-off receipts contributed to this, while expenditure remained largely under control.

Although the fiscal stance is expected to be less restrictive, the general government deficit is forecast to continue shrinking, outperforming the government’s targets. The good revenue performance has continued in early 2017 and is likely to contribute to the further reduction of the deficit this year. Under the no-policy-change assumption the general government balance is projected to post even a small surplus in 2018. At this pace of fiscal consolidation government debt is forecast to decline steadily and fall under 70% of GDP in 2018. Fiscal risks, however, remain high as spending pressures mount and gains in revenue collection are not yet sufficiently institutionalised. Refinancing needs and interest payments are significant. Debt dynamics and servicing are sensitive to exchange rate fluctuation, while fiscally important structural reforms remain unfinished and are a persistent source of uncertainty.