Serbian producers exporting duty-free to the EU since 2000

Customs duties for all industrial and agricultural products coming from Serbia into the EU (aside from only a few agricultural products protected by the preferential tariff quotas) were abolished by the EU in 2000 with the application of the Autonomous Trade Measures. This regime was unilaterally granted by the EU to Serbia in 2000 and it represented the most extensive trade concessions regime that was ever granted by the EU to any country or group of countries. This meant that the EU had immediately abolished all customs duties and quantitative restrictions on imports of all industrial and agricultural products, aside from only a few agricultural products that are under the preferential tariff quota regime (sugar, baby beef, wine and a few types of fish).

Serbia gradually removing customs protection since 2009

For Serbia, the reduction of import duties for goods originating in the EU started nine years later in January 2009 when Serbia voluntarily initiated the implementation of the trade-related part of the Stabilisation and Association Agreement, called the Interim Agreement. This agreement introduced asymmetric trade liberalisation in favour of Serbia for both industrial and agricultural products. In other words, since 2009, trade liberalisation on the Serbian side has been following a gradual and predictable six years’ liberalisation schedule, reflecting the level of sensitivity of products for Serbian producers. At the same time, a level playing field was being gradually introduced through the implementation of a predictable customs regime, anti-trust, state aid rules as well as the intellectual and industrial property protection regime in Serbia. This gradual trade liberalisation schedule was supposed to enable Serbian producers to progressively prepare for growing competition from the EU.

From January 1, 2014, Serbia and the EU have reached the sixth and final year of the trade liberalisation schedule. However, the most sensitive agricultural products for Serbian farmers will remain protected with customs duties until Serbia’s accession to the EU, notably all kinds of meat, yoghurt, butter, certain types of cheese, honey, certain vegetables and flour, with their tariff protection ranging from 20% to 50% of the most favoured nation (MFN) duty that Serbia applies to the rest of the world.

Entry into force of the Stabilisation and Association Agreement

The entry into force of the Stabilisation and Association Agreement in September 2013 further reinforced economic benefits of the Interim Agreement. A number of new provisions contributed to improving the business environment in Serbia, including provisions related to the free movement of capital, public procurement, standardisation, rights of establishment and supply of services. These policy changes provide a clearer and safer framework for investors and businesses, thus creating new momentum for the Serbian economy in attracting investments and improving the level playing field. Implementation of the Stabilisation and Association Agreement is supposed to raise standards of doing business for Serbian companies, gradually preparing them to compete with the EU companies on the Single Market and increasing their competitiveness in the long run.

For Serbian citizens, this should generate more variety of choice and decrease the prices of goods. Finally, the gradual opening of the market for public tenders to EU companies should result in more competition in public procurement procedures and is supposed to consequently bring better value for money to Serbian tax payers – better public works, supplies and services with less tax payers’ money.

Benefits from Serbia – EU trade

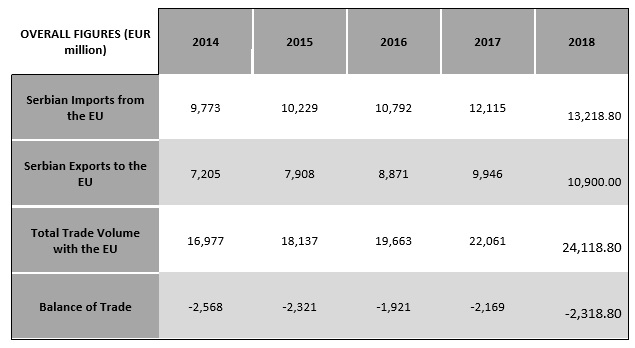

Serbia has substantially benefited from trade and economic integration with the EU. The EU is traditionally Serbia’s key trading partner accounting for 67% of Serbia’s total exports and more than 60% of Serbia’s total imports of goods in 2018 with similar percentages persisting over the years. The value of Serbian exports to the EU more than tripled from EUR 3.2 billion in 2009 to EUR 10.9 billion in 2018!

Serbia’s exports to the EU have been growing. Furthermore, coverage of imports by exports on the Serbian side vis-a-vis the EU have been improving from below 50% in 2009 to approx. 82% in 2018 (82% of imports from the EU were covered by Serbian exports to the EU).

Individual EUMSs traditionally top the list of Serbia’s most important trade partners in goods, notably Italy and Germany, but also Romania as an important export destination and Hungary as important country of origin for Serbian imports. Serbia exported more than 12% of total goods exports to Italy alone and almost 12% to Germany in 2018. On the import side, Serbia imported more than 13% of all shipments from Germany and another 9% from Italy alone.

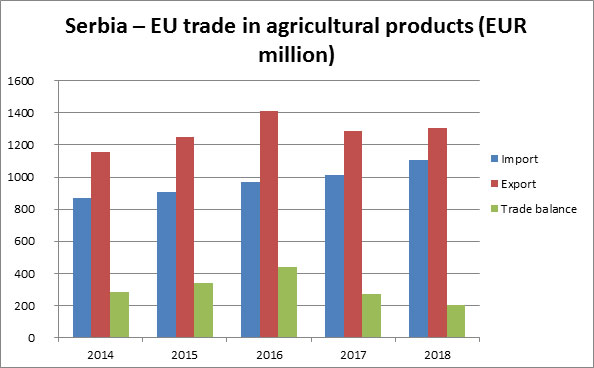

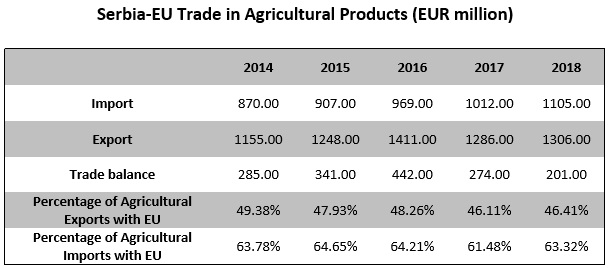

Concerning trade in agricultural and food products, Serbia enjoys a surplus vis-a-vis the EU. The surplus reached its peak in 2016 at more than EUR 440 million, but it fell to EUR 201 million in 2018 due drought that affected Serbian agricultural production in 2017..

The significance of the EU market as an export destination for Serbian agricultural produce is considerable, as around half of Serbia’s agricultural exports are shipped to the EU. In 2018, Serbian agricultural exports to the EU accounted for 46% of total agricultural exports. Serbia’s agricultural exports to the EU more than doubled over the past decade, steadily rising from EUR 640 million in 2009 to almost EUR 1.3 billion in 2018. At the same time, Serbian imports of agricultural products from the EU increased from EUR 440 million in 2009 to around EUR 1.1 billion in 2018.

Investment benefits for Serbia

Foreign direct investment coming from the EU accounted for almost 70% of total FDI coming to Serbia over the past nine years, from 2010 until 2018, according to the latest information provided by the National Bank of Serbia. In absolute terms, FDI from the EU countries reached over EUR 13 billion for the past nine years.

Companies from the EU have been the leading investors in Serbia over the previous decade. These companies have brought efficiency, modern technology and know-how into the Serbian economy. This has in turn significantly increased productivity and competitiveness of the Serbian economy, boosting its export potential, increasing budget revenues and generating economic growth. Ultimately, opening up of the Serbian market to companies from the EU has generated a variety of choice and lower prices for consumers.

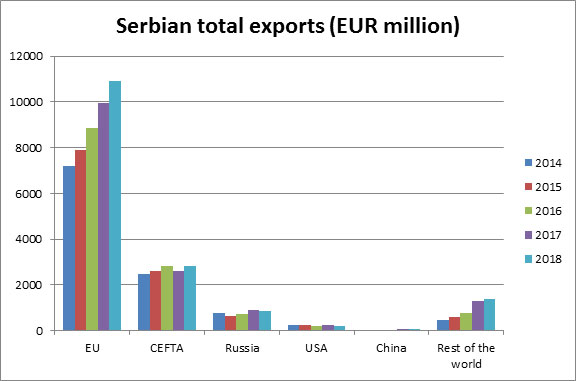

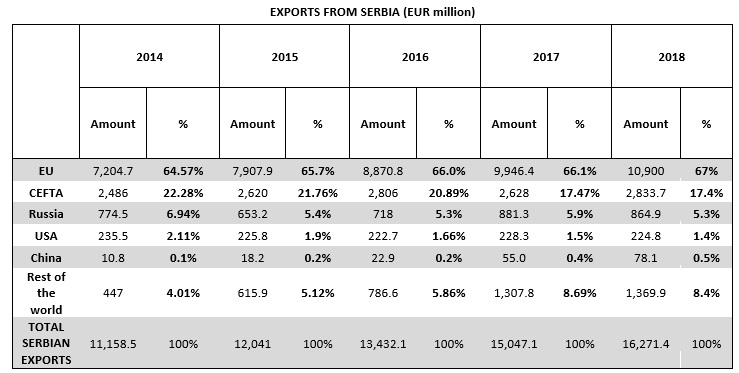

Exports from Serbia

- The value of exports to the EU accounts for 67% of total Serbian exports in 2018, with constant upward trend.

Source: Statistical Office of the Republic of Serbia

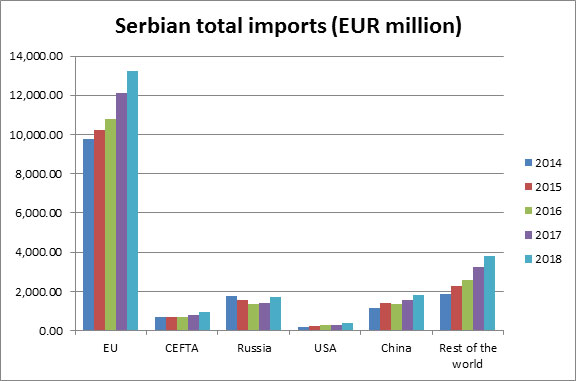

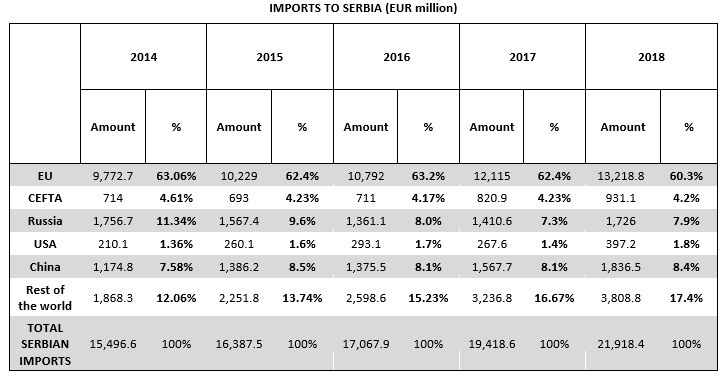

Imports to Serbia

- More than 60% of all imports arriving to Serbia come from the EU.Imports to Serbia

Source: Statistical Office of the Republic of Serbia

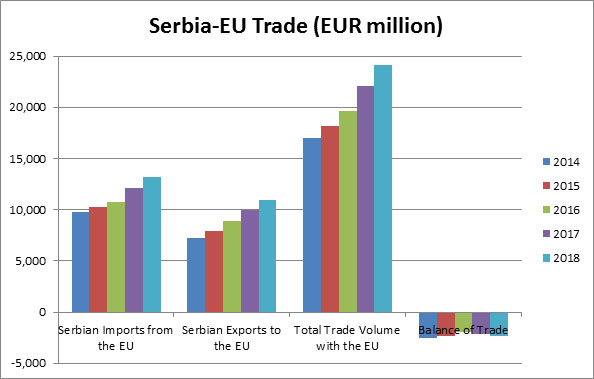

Serbia-EU Trade

Serbia-EU Trade

- Total Serbia-EU trade volume is steadily increasing

Source: Statistical Office of the Republic of Serbia

Serbia-EU Trade in Agricultural Products

- Serbia enjoys a surplus in agricultural trade vis-a-vis the EU.

Source: Ministry of Agriculture, Forestry and Water Management of the Republic of Serbia

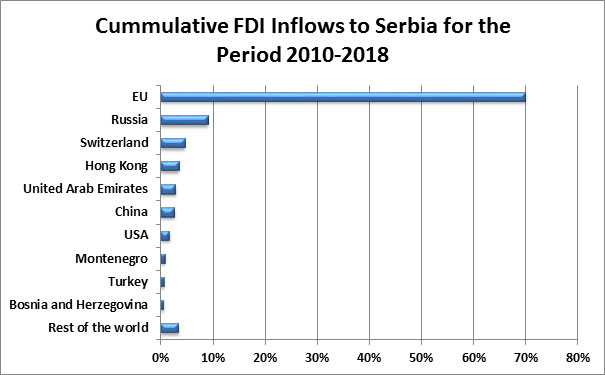

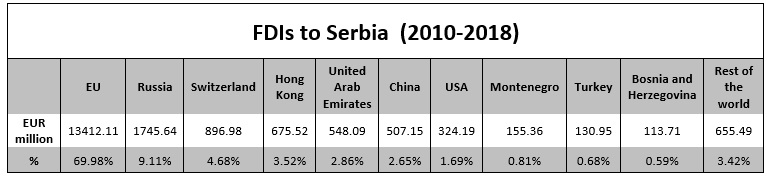

FDIs to Serbia

- EU companies invested almost 70% of the cumulative FDI inflows to Serbia over the past nine years – amounting to over EUR 13 billion in total!

Source: National Bank of Serbia

Information corner for potential exporters to the EU

Information corner for potential exporters to the EU

The EU Trade helpdesk – your online guide to access the EU market

Link: http://tradehelpdesk.europa.eu

What is it?

The EU Trade Helpdesk is a free online service created primarily to support interested exporters in third countries. It contains up-to-date essential information regarding all kinds of formalities that exporters need to be aware of to export to the EU market. The online database delivers country- and product-specific data in several languages.

What should every potential exporter to the EU know?

There is no mystery about how to access the EU market. The European Commission put in place a free internet tool including all the essential information the potential exporters may need. It is much more than a tariff database. Companies considering exports to the EU can check in a few clicks:

- Duties they pay at EU customs.

- Health, safety, marketing and technical standards their products need to meet.

- Rules and proofs of origin: how to declare the economic nationality of their product when claiming duty discounts.

- Internal taxes applied in the importing country.

- Forms to send with their shipments.

- Trade statistics related to their products.

The Export Helpdesk website and database are accessible from all around the world free of charge.